TECH

LaSRS Login Process: Everything You Need to Know for Easy Access

The LaSRS Login portal provides Louisiana State employees and retirees with an efficient way to access their retirement and benefits information. Understanding how to sign in, reset your password, and utilize all the features LaSRS offers is essential for maximizing the platform’s benefits. Whether you’re trying to log into the system for the first time or need help resetting your password, this guide is designed to assist you step by step.

In this article, we will dive deep into everything you need to know about LaSRS Login, including how to access your dashboard, recover your password, and troubleshoot common issues. By the end of this guide, you’ll have a thorough understanding of how to navigate LaSRS and ensure that your retirement and benefits information is up-to-date.

What is LaSRS?

The Louisiana State Retirement System (LaSRS) is a government-backed platform that allows state employees and retirees to manage their pensions and other employee benefits. Much like other portals such as the Publix Oasis Employee Portal, LaSRS is designed to provide employees with easy access to crucial retirement information, including benefit plans, contribution history, and health insurance options.

For users affiliated with LaSRS, being able to efficiently navigate the platform is crucial. Whether you’re logging in to check your pension balance or download important documents, knowing how to properly use the portal ensures that you never miss out on your entitlements.

Importance of the LaSRS Login Portal

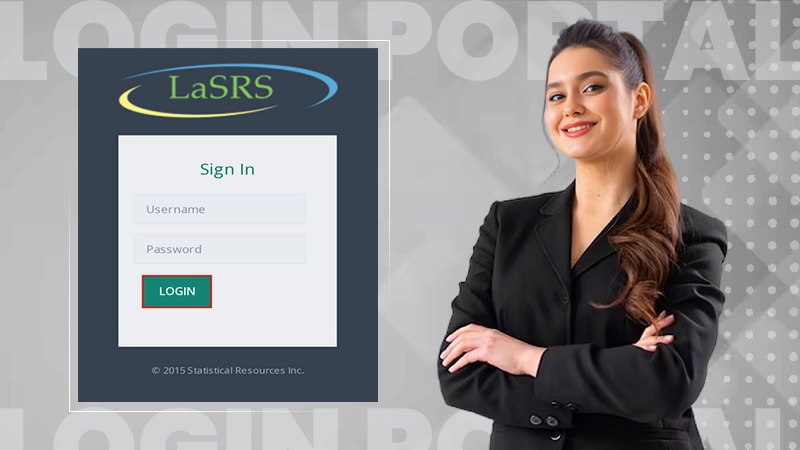

![Lasrs Login at www.lasrs.statres.com/login - Step by Step [2024]](https://ityug247.com/wp-content/uploads/2023/07/Lasrs-login.webp)

Before we dive into the LaSRS Login process, let’s first talk about why accessing this portal is so important. For anyone affiliated with LaSRS, this online platform provides key resources, such as:

- Pension Information: Track your retirement savings and how much you’ve accumulated.

- Health Benefits: Access your healthcare options and claims.

- Personal Information: Update your address, phone number, and email.

- Documents and Forms: Download the latest forms for retirement, healthcare benefits, and more.

The LaSRS portal is your gateway to ensuring that you are getting the most out of your benefits and retirement plans, so it’s essential to understand how to use it effectively.

The LaSRS Login Process

Let’s walk through the LaSRS login process to ensure that you can easily access your dashboard and begin managing your benefits.

Step 1: Visit the Official LaSRS Website

The first step in the LaSRS login process is to visit the official LaSRS website. You can do this by typing the URL directly into your browser or by searching for “LaSRS login” on your preferred search engine. Make sure you’re visiting the correct site to avoid potential security risks.

The website will typically have a clean, user-friendly layout with all essential features clearly visible.

Step 2: Locate the Login Section

Once you’re on the homepage, you should be able to easily locate the login section. This is usually found at the top-right corner of the page or in the center. There will be fields labeled “Username” and “Password.” If you’re having trouble finding it, you can also look for a “Login” or “Sign In” button.

Step 3: Enter Your Credentials

After locating the login fields, enter your username and password carefully. Double-check for any typos to ensure that your login attempt is successful. Remember, the system is case-sensitive, so make sure you use the exact combination of upper and lowercase letters as you initially registered.

If this is your first time logging in, you might need to register for an account. Look for the “Sign Up” or “Register” link if necessary, and follow the prompts to create a new account.

Step 4: Click “Login”

Once you’ve entered your credentials, click the “Login” button. If everything is correct, you should be redirected to your LaSRS dashboard, where you can begin managing your benefits.

If there is any issue with your credentials, you’ll see an error message prompting you to re-enter the details.

How to Reset Your LaSRS Password

There’s no need to worry if you’ve forgotten your LaSRS login password. The platform provides an easy-to-follow process to reset it. Here’s how:

Step 1: Go to the LaSRS Login Page

If you’ve forgotten your password, head back to the LaSRS login page. Under the login fields, look for a link that says “Forgot your password?” or “Reset Password.” Clicking this link will take you to the password recovery section.

Step 2: Enter Your Email or Username

Once you’ve clicked the reset link, you’ll be asked to provide the email address or username linked to your LaSRS account. Be sure to enter the correct information so the system can send you instructions for resetting your password.

Step 3: Check Your Email

After submitting your email or username, LaSRS will send a password reset link to the associated email address. Open your inbox and look for the email from LaSRS. If you don’t see it in your main inbox, check your spam or junk folder.

Step 4: Reset Your Password

Click the reset link in the email. This will direct you to a page where you can enter a new password. Make sure your new password is strong and follows the guidelines set by LaSRS, typically requiring a mix of uppercase and lowercase letters, numbers, and special characters.

Step 5: Log In with Your New Password

Once your password has been successfully reset, return to the LaSRS login page, and enter your username and newly created password. You should now have access to your LaSRS dashboard.

Common LaSRS Login Issues and Solutions

While the LaSRS login process is usually straightforward, there are a few common issues that users may encounter. Here are some troubleshooting tips to help you resolve login problems.

Incorrect Username or Password

One of the most common login issues is entering an incorrect username or password. This could happen if you’ve forgotten your credentials or typed them incorrectly. To fix this, double-check the username and password you’ve entered. If you’re still having trouble, use the password reset process.

Account Locked

If you’ve entered your login information incorrectly multiple times, your account may be temporarily locked for security reasons. In this case, you will need to wait for a few minutes before trying again, or contact LaSRS support for assistance in unlocking your account.

Website Down for Maintenance

On rare occasions, the LaSRS website may undergo scheduled maintenance or experience technical difficulties. If the website isn’t loading or you can’t access your account, try visiting again later. You can also check the LaSRS social media pages for updates on any service interruptions.

Browser Compatibility Issues

Sometimes, your browser may cause issues when trying to access the LaSRS login page. Try clearing your browser cache or using a different browser. LaSRS is best accessed using up-to-date versions of Chrome, Firefox, or Safari.

Understanding the LaSRS Dashboard

Once you’ve logged into your LaSRS account, you will land on your LaSRS dashboard, which provides all the information you need regarding your retirement and benefits. Here’s an overview of the key features of the LaSRS dashboard:

Personal Information

The Personal Information section of your dashboard contains essential details such as your name, contact information, and employment history. You can update your address, email, and phone number here to ensure that LaSRS has your most accurate and current information.

Retirement Plan Information

This section gives you an overview of your pension contributions, including how much you’ve saved, your projected retirement benefits, and more. You’ll also find links to any retirement planning resources that LaSRS offers to help you better plan for your future.

Health Benefits

If you’re eligible for health benefits through LaSRS, you can find all related information under the Health Benefits section. This includes details on your current health plan, coverage options, and claims history. You may also be able to download forms related to healthcare benefits.

Forms and Documents

In the Forms and Documents section, you can access and download any important forms related to your pension or benefits. This section is vital for handling official paperwork, such as applications for retirement or health benefits.

Notifications and Messages

The Notifications and Messages area contains updates from LaSRS, such as system updates, retirement plan changes, or new documents available for download. Be sure to check this section regularly to stay informed.

Conclusion

The LaSRS Login portal is an essential tool for managing your retirement, healthcare benefits, and personal information. Understanding how to navigate the portal, reset your password, and use all of its features is crucial for taking full advantage of the services LaSRS offers.

By following the steps outlined in this guide, you should now have a complete understanding of how to access your LaSRS account and troubleshoot any issues you may face. Whether you’re a current employee or retiree, knowing how to log in and use the dashboard will help you manage your benefits effectively.

If you encounter any further issues, don’t hesitate to contact LaSRS support for assistance. Your retirement and benefits are important, and LaSRS is here to help you access them with ease.

Also Read: Gold Price FintechZoom

TECH

A Detailed guide about the working class of UAE

UAE is a place where a huge part of the population belongs to expatriates. Nonetheless, the nation is known as an economic hub across the world. Cities like Dubai and Abu Dhabi have announced several different programs to promote businesses, companies, and organizations to locate within the UAE. The cities have promoted many startups in recent years. The cities have witnessed a huge influx of ideas and innovations. This is done to encourage businesses to locate within the country and promote the business environment. This will ultimately lead to economic growth The working class is given the key importance while encouraging businesses in the territory the governments of different states have announced workers protection programs. They will ensure that the working class feels safe, secure, and protected. Furthermore, our labour and employment lawyers, are the great source to learn UAE Labour Law. Our lawyers and legal consultant are also expert dealing in mediation and litigation.

Workers Protection in UAE

Workers protection programs are the initiatives to secure the rights of all workers and the labor force. This is done to ensure the safety of everyone working in UAE irrespective of nationality, background, and ethnicity. A great number of workers in the UAE consist of migrant workers. Local people form a smaller number of workers as compared to expatriates and foreigners. However, the UAE labor laws are strict. They are designed in a way that ensures the protection.

Rights of Labour in UAE: Fully Protected

The rights of labours and employees are protected under UAE labor and employment laws. They protect them in relation to delayed salaries, unfair dismissal, wrongful termination, workers’ compensation, and much more. Furthermore, there are a lot of disputes which need to be resolved. They are resolved in the UAE following the UAE labor laws. The rules and regulations act as fundamental to resolving disputes, conflicts, and disagreements between employees and employers.

- Moreover, the UAE labor laws provide guidelines regarding rights and responsibilities. It caters to not only the employees but also the employers. The laws sensibly deal with matters like equal pay, workplace discrimination, unfair dismissal, wrongful termination, workers’ agreement, compensation, longer working hours, and much more.

UAE Labour Courts

UAE labor courts play a crucial role in dealing with disputes and problems that arise between the employer and employee. There are proper laws for the domestic workers who are part of the workforce in the UAE. A Domestic worker includes house helpers, house cleaners, servants at home, and others. Their job is to assist the people in managing their household chores. Normally, they are involved in cleaning, cooking, driving, and other related services.

Usually, families require their help. Domestic workers have the full right to get paid leave just like any other employee in the UAE. They are also entitled to rest periods.

Rights of Domestic Workers

Domestic workers have full rights just like the workers. Unfortunately, domestic helpers are prone to domestic abuse. They also have limited exposure as they normally stay within the premises of the house. They have restricted exposure to meeting people. The domestic worker’s laws are designed in a way that protects them from different kinds of abuse and exploitation in any way. The domestic worker’s laws ensure that nobody in the workplace is hurt, abused, or exploited by the employer in any potential. According to the law, domestic helpers are entitled to receive salaries within 10 days of the due date.

Health and Safety Regulations

There are adequate Health and Safety Regulations, which must be followed. The UAE not only protects the rights of the working class but also ensures their health and safety. There are proper health and safety standards that are made according to international best practices.

Furthermore, construction companies in the UAE are bound under the UAE labor laws to adhere to strict health and safety procedures. This is implemented to reduce the chances of physical injuries. Normally there are some types of industries where there are greater chances of physical injuries. Nonetheless, the government of the UAE is highly dedicated to ensuring a safe and sound environment for the working class in the UAE. They treat local workers and migrants equally. The worker’s protection programs are introduced in the UAE that are designed for the rights and safety of everyone who forms part of the working class.

WPS or Wage Protection System

The Wage Protection System (WPS) are programs that are designed to support the working class of the UAE. They were introduced by the Ministry of Human Resources and Emiratization (MOHRE). The workers are entitled to receive the salaries and wages on a timely basis. There should be no delay or postponement in the payments. Additionally, the employers have to send the salary via a verified financial institution.

There are no disputes or conflicts over unverified sources. The salary distribution must be done on time and from an authorized source of distribution. The Wages Protection System WPS ensures that employers are compliant with the UAE labor laws. They must address the issues related to non-payment. WPS also ensures a record and track for the payment of salary or wage.

The labor lawyers in UAE are there to assist the employees and employers with their disputes. Nevertheless, the proper guidelines to them regard safe ways to work in the

UAE while avoiding non-compliance.

Besides, the skillful and specialist labor lawyers in UAE offer useful information to the workers or employees who are part of the UAE working class. They offer invaluable pieces of advice to workers according to the UAE labor law, the regulations are subject to changes and the labor lawyers in UAE have full-fledged information about them. They ensure safer working conditions for the workers.

If the workers are facing any kind of problems, the attorneys can guide them on the way out to sort the matters. The city is home to top and competent lawyers in UAE who can assist in taking the next step. They will ensure the employee is not discriminated against in the working environment. They offer legal support to workers in the UAE who can better handle labor disputes related to unpaid salaries, harassment, compensation, and others.

The labor lawyers in UAE help the workers and employees working in different professions and sectors. The legal status of employment comes with a great deal of challenges which can be addressed through labor lawyers in the UAE.

TECH

Understanding EX HMIS and ATEX Air Conditioners for Industrial Safety

In the modern industrial landscape, safety and efficiency are paramount. When dealing with hazardous environments, understanding the role of specialized equipment like EX HMIS systems and ATEX air conditioners becomes crucial. This article explores these essential components, their functions, and why they matter for industries operating in high-risk zones.

What is EX HMIS?

Definition and Purpose

EX HMIS (Hazardous Materials Information System) refers to systems designed to handle hazardous materials safely. These systems are particularly relevant in environments with explosive gases, vapors, or dust. The term “EX” signifies equipment or systems certified to operate in potentially explosive atmospheres.

Key Features of EX HMIS

- Explosion-Proof Design: EX HMIS equipment is designed to prevent sparks or high temperatures that could ignite hazardous substances.

- Real-Time Monitoring: These systems monitor environmental conditions continuously, providing alerts for any changes.

- Compliance Standards: They adhere to international safety standards like IECEx or ATEX, ensuring reliable operation in hazardous zones.

Applications of EX HMIS

- Oil and Gas: Monitoring and controlling operations in refineries and offshore rigs.

- Chemical Plants: Ensuring safe handling of volatile substances.

- Mining: Managing equipment in environments with combustible dust.

Introduction to ATEX Air Conditioners

What is ATEX?

ATEX (ATmosphères EXplosibles) is a European directive that ensures equipment used in explosive atmospheres meets stringent safety requirements. An ATEX air conditioner is specifically designed for temperature control in hazardous environments.

Key Features of ATEX Air Conditioners

- Explosion-Proof Components: Designed to prevent ignition sources, such as sparks or overheating.

- Durable Construction: Built to withstand harsh industrial conditions, including corrosive substances and extreme temperatures.

- Customizable Options: Tailored to meet specific environmental and operational needs.

Benefits of Using ATEX Air Conditioners

- Enhanced Safety: Mitigates risks of explosions by maintaining controlled temperatures in hazardous zones.

- Regulatory Compliance: Meets European safety standards, reducing liability concerns.

- Improved Efficiency: Ensures optimal functioning of equipment in challenging conditions.

Why EX HMIS and ATEX Air Conditioners Are Crucial for Industrial Operations

Safety in Hazardous Environments

Industries operating in explosive atmospheres must prioritize safety. EX HMIS and ATEX air conditioners reduce the risk of accidents, protecting both personnel and equipment.

Regulatory Compliance

Failure to comply with safety directives like ATEX can lead to significant penalties and operational shutdowns. Implementing compliant systems ensures adherence to legal requirements.

Increased Operational Efficiency

By maintaining a controlled environment, these systems enhance the reliability and performance of industrial processes.

Cost-Effectiveness

Although the initial investment may be higher, the long-term benefits of reduced downtime and increased safety outweigh the costs.

Choosing the Right Equipment

Factors to Consider

- Zone Classification: Determine the level of risk in your environment (e.g., Zone 1, Zone 2).

- Material Compatibility: Ensure the equipment is resistant to the specific chemicals or substances in your facility.

- Maintenance Requirements: Opt for systems with minimal upkeep needs to reduce downtime.

Working with Certified Suppliers

When selecting EX HMIS and ATEX air conditioners, always choose certified suppliers like Specifex. Certified products come with the assurance of quality and compliance.

Installation and Maintenance

Proper Installation

Correct installation is critical to the effectiveness of EX HMIS and ATEX air conditioners. Ensure that qualified technicians handle the installation to avoid compromising safety.

Regular Maintenance

Scheduled maintenance is essential to keep these systems running efficiently. Inspections should focus on:

- Electrical Connections: Ensuring they remain secure and free from corrosion.

- Seals and Gaskets: Checking for wear and tear that could compromise safety.

- Performance Testing: Verifying that the system operates within specified parameters.

Advancements in Technology

Smart Systems

Modern EX HMIS and ATEX air conditioners integrate smart technologies like IoT and AI. These advancements allow for:

- Predictive Maintenance: Identifying potential issues before they lead to failures.

- Remote Monitoring: Enabling real-time oversight from centralized control rooms.

- Energy Efficiency: Optimizing power usage without compromising safety.

Eco-Friendly Solutions

Manufacturers are increasingly focusing on eco-friendly designs, such as using refrigerants with lower global warming potential (GWP) in ATEX air conditioners.

Conclusion

EX HMIS and ATEX air conditioners are indispensable for industries operating in hazardous environments. They not only ensure compliance with safety regulations but also enhance operational efficiency and protect lives and assets. By partnering with trusted suppliers like Specifex, businesses can invest in reliable solutions that meet their specific needs.

Whether you are in oil and gas, chemical processing, or any other industry requiring explosion-proof equipment, understanding these systems is the first step towards safer and more efficient operations.

TECH

How Long Can a Company Hold Your 401(k) After You Leave?

Leaving a job can feel like turning the page on an old chapter, but one critical aspect of your professional journey often lingers: your 401(k) retirement account. Whether you’re moving to a new company, starting your own business, or taking a career break, understanding what happens to your 401(k) after you leave is essential. Many people are left wondering: How long can a company hold onto my 401(k) after I leave? The answer depends on several factors, including the balance in your account, your former employer’s policies, and federal regulations. If you’re considering your options, meetbeagle.com is a helpful resource for navigating retirement accounts and planning your financial future. In this article, we’ll explore how long your previous employer can retain your 401(k), the rules that govern this process, and the choices you have for managing your retirement savings.

What Happens to Your 401(k) When You Leave a Job?

When you leave a job, your 401(k) doesn’t disappear—it remains intact and legally belongs to you. However, its management and location depend on your choices and your former employer’s policies. Companies do not have the right to withhold your funds indefinitely, but there are specific rules and timelines regarding how long they can retain your account before taking further action.

The Key Factors That Determine How Long a Company Can Hold Your 401(k)

Account Balance Matters

The balance in your 401(k) plays a significant role in determining how long your former employer can hold onto it.

Balances Over $5,000

If your account balance exceeds $5,000, your former employer is generally required to leave your 401(k) in the company’s retirement plan until you decide what to do with it. They cannot force you to move the funds or cash out.

Balances Between $1,000 and $5,000

For balances in this range, employers are allowed to move your funds into an Individual Retirement Account (IRA) if you don’t take action after leaving the company.

Balances Under $1,000

If your balance is less than $1,000, your employer can cut you a check for the total amount, effectively cashing out your 401(k). However, this action may trigger taxes and early withdrawal penalties if you’re under the age of 59½.

Company Policies and Plan Rules

Beyond federal regulations, individual companies may have specific rules governing how long they can hold onto your 401(k). Some employers provide more flexibility, while others may act quickly to transfer or cash out accounts with low balances. Always refer to your plan’s Summary Plan Description (SPD) for details about your company’s 401(k) policy.

Federal Rules for 401(k) Retention and Distribution

Federal laws, overseen by the Employee Retirement Income Security Act (ERISA), set strict guidelines for how employers must manage former employees’ 401(k) accounts.

Automatic Rollovers

For balances between $1,000 and $5,000, the law allows companies to initiate an automatic rollover into an IRA if the former employee doesn’t make a decision within a certain timeframe. This ensures the funds remain tax-advantaged and avoid early withdrawal penalties.

Required Notifications

Employers are required to notify you about any actions they plan to take with your 401(k). For example, if your account is being rolled over to an IRA or cashed out, the company must provide written notice in advance.

Timeline for Action

The exact timeline for how long a company can hold your 401(k) varies, but most employers allow a grace period of several months to a year before taking any action, particularly for smaller balances.

Your Options for Managing a 401(k) After Leaving a Job

Once you leave a job, you have several options for managing your 401(k):

Leave It with Your Former Employer

If your balance is over $5,000, you can choose to leave your 401(k) in your former employer’s retirement plan. This option may be appealing if the plan offers excellent investment options and low fees. However, leaving your 401(k) behind can make it harder to keep track of your retirement savings over time.

Roll It Over to a New 401(k)

If you’re starting a new job that offers a 401(k) plan, you can roll your old 401(k) into your new employer’s plan. This consolidates your retirement savings and allows you to continue contributing to the account under your new plan.

Roll It Over to an IRA

Rolling your 401(k) into an Individual Retirement Account (IRA) gives you greater control over your investments and often provides more diverse investment options. IRAs also typically have lower fees than employer-sponsored plans.

Cash It Out

You can choose to cash out your 401(k), but this is usually the least favorable option. Cashing out triggers income taxes on the full amount, and if you’re under 59½, you’ll face an additional 10% early withdrawal penalty.

Why You Should Act Quickly

Although employers are legally required to follow specific rules, it’s always in your best interest to act promptly when dealing with a 401(k) after leaving a job. Failing to take action could lead to:

Automatic Rollovers to IRAs with Higher Fees

The IRA your employer chooses may have higher fees or less favorable investment options than other available IRAs.

Lost Accounts

If your employer can’t reach you, your account may be deemed “unclaimed property” and transferred to a state’s treasury department.

Tax Implications

If your account is cashed out without your knowledge, you could face significant tax consequences.

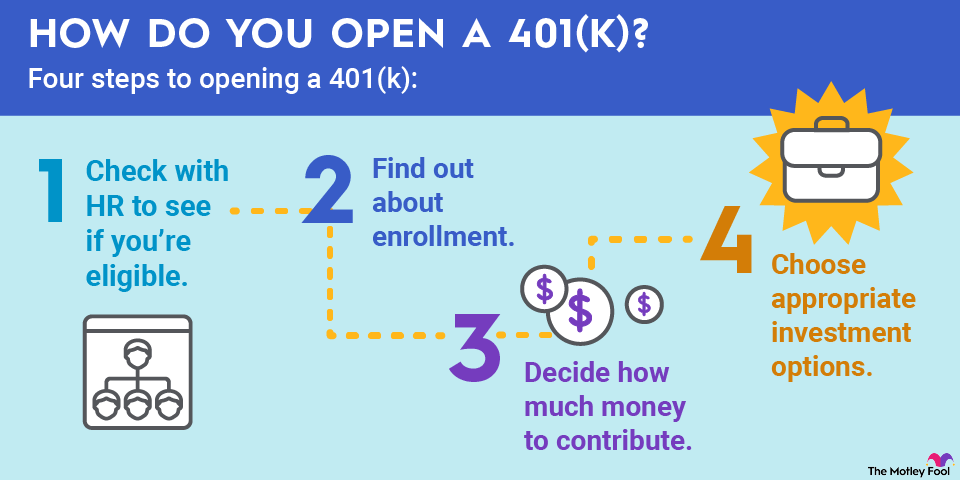

How to Take Control of Your 401(k)

To ensure your 401(k) is managed effectively after you leave a job, follow these steps:

Contact Your Former Employer

Reach out to the HR or benefits department to confirm your account balance, options, and deadlines for making a decision.

Research Your Options

Compare the benefits and drawbacks of leaving your 401(k) in your old plan, rolling it over, or cashing it out.

Choose a Rollover Option

If you decide to roll over your 401(k), coordinate with your new employer or financial institution to ensure a smooth transfer.

Keep Your Information Updated

Make sure your former employer has your current contact information to avoid losing track of your account.

Conclusion

Your 401(k) is a vital part of your retirement savings, and understanding how long your former employer can hold onto it is crucial for making informed financial decisions. While federal rules and company policies provide guidelines, the responsibility ultimately falls on you to take action and safeguard your retirement funds. For help navigating the complexities of managing your 401(k), resources like meetbeagle.com can provide expert advice and tools to simplify the process. By taking charge of your retirement savings now, you can ensure a more secure financial future.

Also Read: money6x.com Employment

-

LATEST2 months ago

LATEST2 months agoInfluencers GoneWild: Stories That Will Blow Your Mind

-

TECHNOLOGY2 months ago

TECHNOLOGY2 months agoYour Ultimate Guide to tech.desacanggu.id: Canggu’s Tech Hub

-

CRYPTO2 months ago

CRYPTO2 months agoYour Guide to ECryptoBit.com Wallets: The Ultimate Digital Asset Solution

-

TECHNOLOGY1 month ago

TECHNOLOGY1 month agoHow To Choose A Web Design Company In 2025

-

CRYPTO1 month ago

CRYPTO1 month agoFoster at CryptoProNetwork: Empowering Blockchain Communities Worldwide

-

TECHNOLOGY2 months ago

TECHNOLOGY2 months agoGomyfinance.com Credit Score: Your Gateway to Financial Freedom

-

CRYPTO1 month ago

CRYPTO1 month agoiCryptox.com DeFi Simplified: Your Roadmap to Financial Freedom

-

HEALTH2 months ago

HEALTH2 months agoDoes Pheromone Cologne Work? Unveiling the Truth Behind Attraction